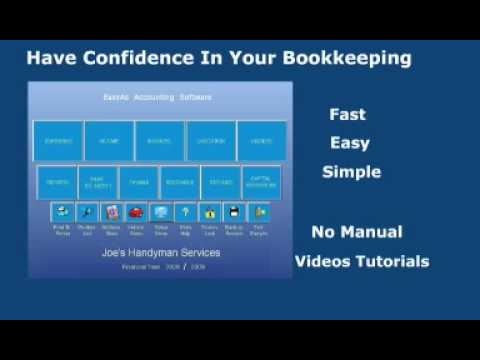

This special package, combined with their ease of use and competitive pricing, makes QuickBooks our best overall accounting software.

They offer a unique package for self-employed business owners that provides the ability to properly track expenses and potential tax write-offs and to calculate what your tax obligations should be on a quarterly basis.

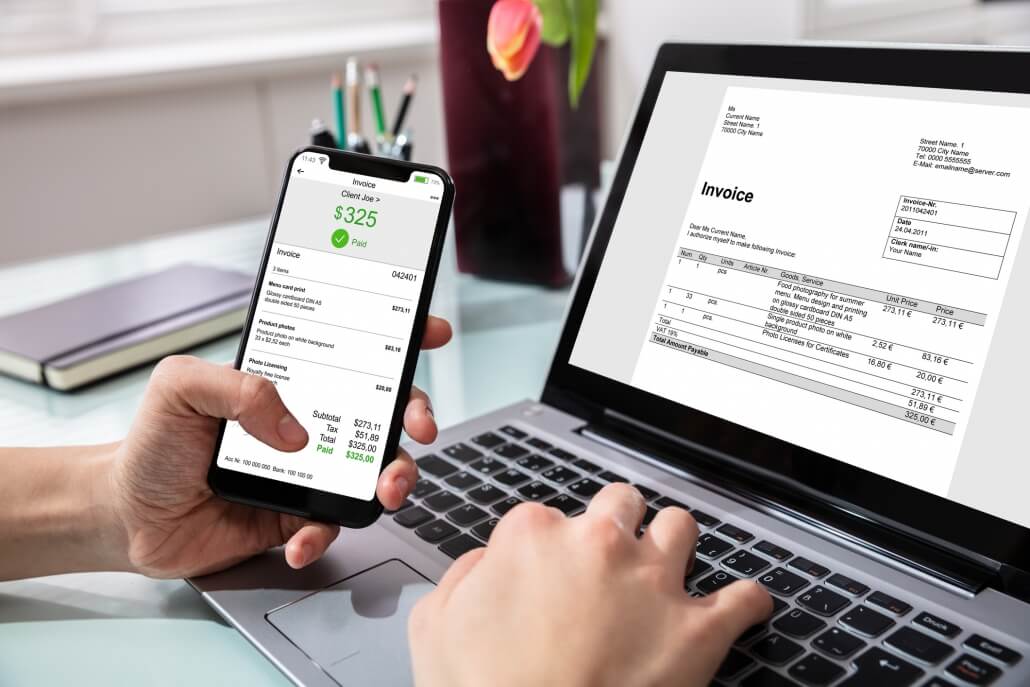

QuickBooks is industry-leading accounting software for all small businesses. With this in mind, we researched more than 15 of the best accounting software options nationwide and narrowed down the list based on factors such as ease of use, self-employed options, and cost. Most self-employed business owners are required to keep track of all these things, and accounting software helps save time, avoid confusion, and keep you out of tax trouble by properly calculating what you owe. The needs of business owners vary based on the business entity they use, but generally, all business owners need to do certain things like capturing receipts, tracking miles, and managing other expenses that may be tax-deductible later. In fact, the IRS’s biggest internal team is the one that works with audits of self-employed individuals, with over 47,000 people looking for mistakes you’ve made. The best accounting software for self-employed business owners will offer specific software options to help business owners meet the unique needs that they have, such as calculating quarterly tax requirements. In addition to tracking transactions, many programs calculate tax liability as well as streamline federal and state filings. Read our advertiser disclosure for more info.Īccounting software is designed to help businesses track their revenue and expenses. We may receive compensation if you visit partners we recommend. We recommend the best products through an independent review process, and advertisers do not influence our picks.

0 kommentar(er)

0 kommentar(er)